How Smart Structuring Helps Banks and Insurers Maximize Regulatory Benefits

Cooperation offers opportunities in Commercial Real Estate Lending

Introduction

Under Basel IV banks are facing more strict capital and liquidity requirements, making it more costly to hold long-term illiquid bank loans. Insurers, at the same time, benefit from relaxed Solvency II rules and will face lower capital charges for these investments. Additionally, the European Commission has recently announced a series of intended reforms: the “Savings and Investment Union”, that should boost investments in European Assets. As a result of these changes, Insurers may seek to expand their role in direct lending, particularly in Real Estate, Private Debt and Infrastructure Loans

All the above mentioned changes will affect the Commercial Real Estate Lending activities in the EU. This short paper explains the changes in both regulatory frameworks, and how these changes in capital requirements will offer opportunities for Banks and Insurers to co-invest in Commercial Real Estate lending (“CRE”).

Basel IV

The new CRR 3 that has become into effect affects banks that are active in CRE-lending under both the Standardized Approach (“SA“), as well as under the Advanced Internal Rating Based Approach (“AIRB“).

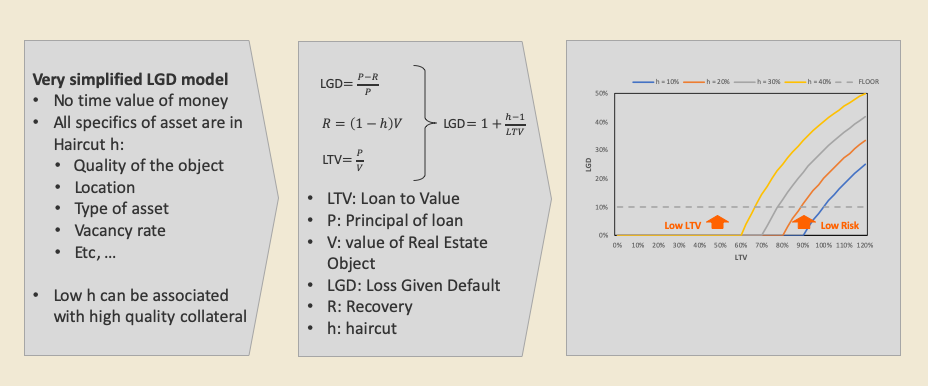

Under the AIRB, an input floor of 10% is introduced for CRE. Figure 1 illustrates for a very simple internal LGD model that this input floor will impact mainly low LTV and low-risk CRE transactions. The LGD model revolves around two parameters: the Loan to Value (“LTV”) and a haircut h. The haircut h, captures many risk drivers of the property: location, type of real estate, quality and length of the leasing contracts, etc. A low haircut, could be interpreted as high quality Real Estate, while a high haircut can be associated with lower quality,or more risky Real Estate. The graph on the right hand side in Figure 1 illustrates how the input floor of 10% affects the low LTV as well as the high quality Real Estate. Although the model is over simplified, it illustrates the point that going below LTVs in the range of 60% - 70% will not lead to lower Capital Charges. So, from a return on equity point of view, there is an incentive for AIRB banks to aim for LTVs that are a bit higher than the LTVs of 50% that are currently seen in the market.

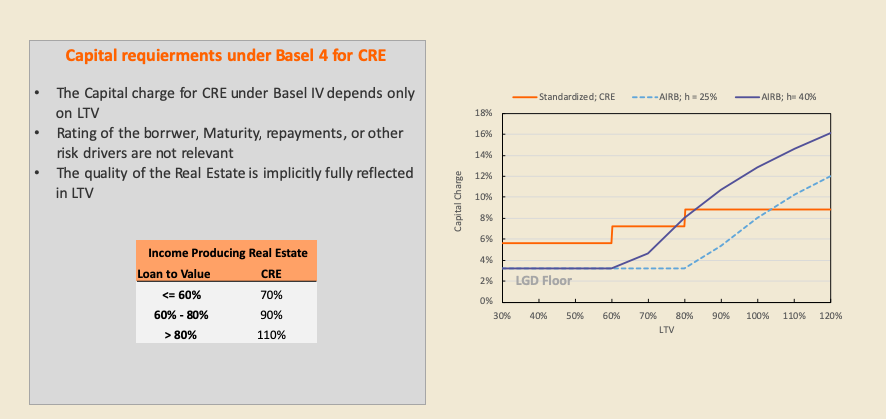

The SA approach works with pre-scribed risk weights. The Capital Charge depends only on a few broad LTV-buckets and not on any other risk-driver, like maturity, rating of the borrower, or repayment schedule, etc. The table on the left hand side in Figure 2 below shows the Risk Weights for CRE as a function on LTV. On the right hand side in Figure 2, a comparison is made between the SA and AIRB approaches for Banks under Basel IV. For LTVs below 70% - 80%, the SA approach is more conservative than the AIRB approach. Note that throughout this paper, a Tier 1 ratio of 8% is assumed to express the risk weights into a Capital Charge. For the AIRB calculations a maturity of 4 years is assumed, as well as a rating of BB.

Solvency II

Like Banks, Insurers can chose to follow a Standardised Approach, or make us of Internal Ratings methodologies when calculating their capital requirements. This paper will focus on the Standardised Approach. For Insurers, the capital requirements for CRE are prescribed in the Market Risk Module. Two sub-modules are relevant:

Property risk sub-module

Spread risk sub-module

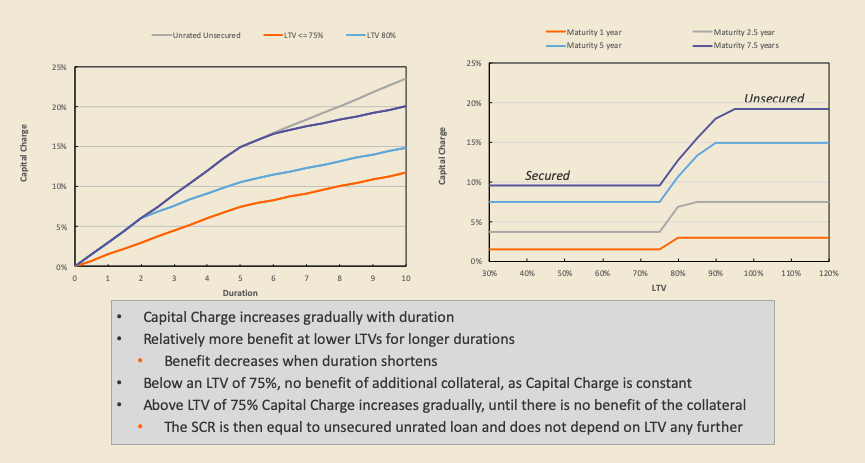

As the property risk sub-module is only relevant for equity investments, this paper will focus on the spread-risk submodule only. The spread risk sub-module has three approaches to calculate the solvency requirements. The approach that is relevant for CRE is the “Bonds and Loans without external credit rating for which the borrower has provided collateral”. Under this prescribed approach, the Capital Charge depends on LTV and maturity, as shown in figure 3. An explanation of the graphs can be found in the accompanying grey box.

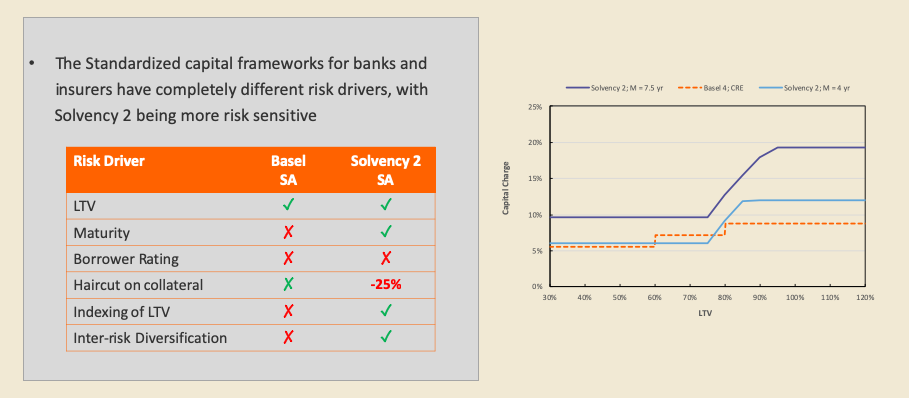

Based on the calculations s desired above, a straightforward comparison between the capital requirements under the Standardized Approaches in Basel IV and Solvency II can be made. This is shown in Figure 4 below. The table on the left hand side shows that the two frameworks have completely different risk drivers. The graph on the right hand side plots the Capital Charges as a function of LTV for both Banks and Insurers. The graph shows that the capital charges are roughly similar. Note that the Capital Charge for Solvency II will gradually become smaller, while the Capital Charge for Basel IV will remain constant during the lifetime of the loan.

The Capital Charges for the Insurer that is shown in the graph, however, are the stand-alone Capital Charges from the Spread Risk sub-module. Not shown in the graph is the impact from the diversification benefits that Insurance companies have under Solvency II. Banks don’t have such diversification benefits under Basel IV, as Capita Charges under Basel IV are simply additive.

Under Solvency II explicit benefit is given to diversification effects when aggregating the capital charges of individual risks. This aggregation is performed via correlation matrices within the same risk type and between risk-types. The size of the diversification benefits therefore depends on the actual composition of the portfolio and balance sheet. The diversification within the market-risk module can be in the range of 20% - 35% and between the risk-types is typically in the range of 15% - 20%. These diversification benefits can therefore lead to a substantial reduction of the capital charges for Insurers. This implies that the Capital Charges for Insurers, as shown in Figure 4, can be reduced by 40%, which brings them well below the capital charges of Banks under the SA approach.

Amendments to the Solvency II Framework

Early 2025, several amendments were approved by the European Commission to the Solvency II framework. These amendments will ease capital requirements for insurers, making it easier to invest in illiquid (bank) loans. In this context, three amendments are relevant:

Reduction of the Risk Margin, which reduces the overall capital for insurers with long-term liabilities and frees up capital for long-term investments

Matching Adjustment for strictly matched portfolios, which reduces the value of liabilities (by adjusting the discount rate) and allowing a wider range of eligible asset, amongst which high quality CRE

Smoothing Volatility Adjustment for portfolios not strictly matched, reducing capital swings caused by short-term fluctuations, which is beneficial for illiquid loans that are held till maturity

EU’s Saving and Investment Union

In March 2025, the European Commission (“EC“) announced plans for a Savings and Investment Union (“SIU”). The idea behind these plans is to encourage savers in the EU to invest in European Assets. The commission proposes to enable this by:

Tax incentives for savers

ESMA to become single supervision of big cross-border asset managers

Reviving Securitizations to free up bank’s balance sheets and increase lending

This initiative is in fact a watered down version of the Capital Markets Union, whcih was launched in 2015 by the EC. Although progress has been made since 2015, the EU Capital Markets remain fragmented, as the member states could not agree on the topics of central supervision, harmonisation of insolvency laws and a common deposit insurance scheme.

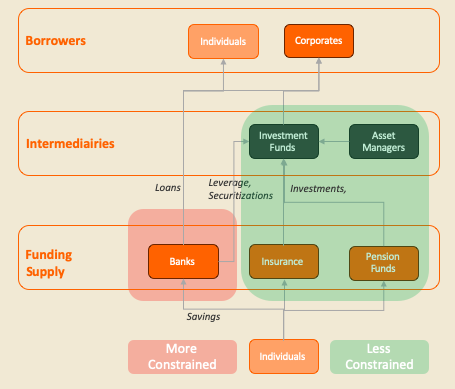

Initiatives by the EU commission are not always followed through, but should the SIU take form, then money will most likely be re-directed from bank savings accounts to insurance and pension schemes, as shown in Figure 5 below. In combination with the changes in the capital charges, as explained in previous sections, this will further encourage Insurers to step into investing in illiquid bank loans.

How Banks, Insurers and borrowers can all benefit

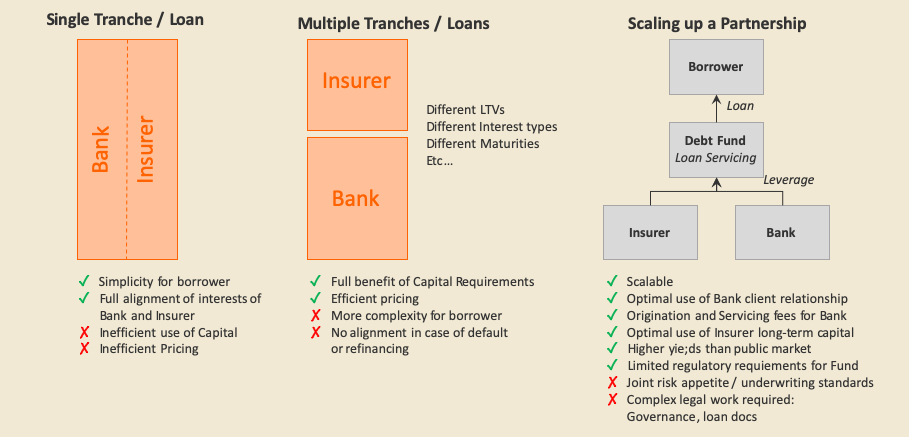

By making optimal use of the different treatment in the Regulatory Capital treatment of Banks and Insurers, all parties may benefit. Both Banks and Insurance companies can have lower capital charges, which can lead to efficient pricing for borrowers. This may come, however, at the expense of some additional complexity.

In order to get this working, the loan needs to be split in different tranches, with one tranche fully aligned with the Bank capital requirements and another Tranche fully aligned with the Insurer’s capital requirements. This is schematically shown in Figure 6 below.

The Tranche of the Bank would be short-term, receiving repayments, and floating rate, while the Tranche of the Insurer would have a more long-term maturity, without repayments and a fixed rate coupon. The collateral can be shared pari-passu between the two tranches, but also a Tier 1 and Tier 2 loan is possible.

Note that this is not capital arbitrage. Banks and insurers, by nature, have different business models and as a consequence they have different balance sheet compositions and different risks, which is reflected in their regulatory frameworks.

Although this approach can be applied on a loan by loan basis, parties can als chose to scale up their partnership, which is illustrated on the right hand side in Figure 6. This requires an upfront investment in aligning underwriting and documentation standards, and establishing an upfront agreement on the workout processes in case of defaults, but once these are established, operational advantages can be established above a loan by loan approach.

Conclusion

The changes in the Basel IV and Solvency II regulatory frameworks offer opportunities for both Banks and Insurance companies to cooperate and make optimal use of their own Frameworks. This holds for illiquid loans in general, and especially Commercial Real Estate. Partnerships can be on a loan by loan basis, but can also be scaled up.

Appreciate the work done in explaining both regulatory regimes as well as pointing the way forward to the potential evolution of regulated institutions in the capital markets. Your diagrams are very good!

Changes are afoot in the US as well, with banks changing lending preferences to take advantage of favourable treatments of exposures treated as 'securitizations' by the US regs. Banks are more likely to partner with private credit managers or BDCs (which themselves are majority funded by Insurers) to provide leverage to meet investor return targets. They earn a higher return on capital on lower risk weighted assets once reduced operational costs (origination, surveillance) are taken into account.